vermont department of taxes myvtax

Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers. B 1200 square foot home with 250 square feet.

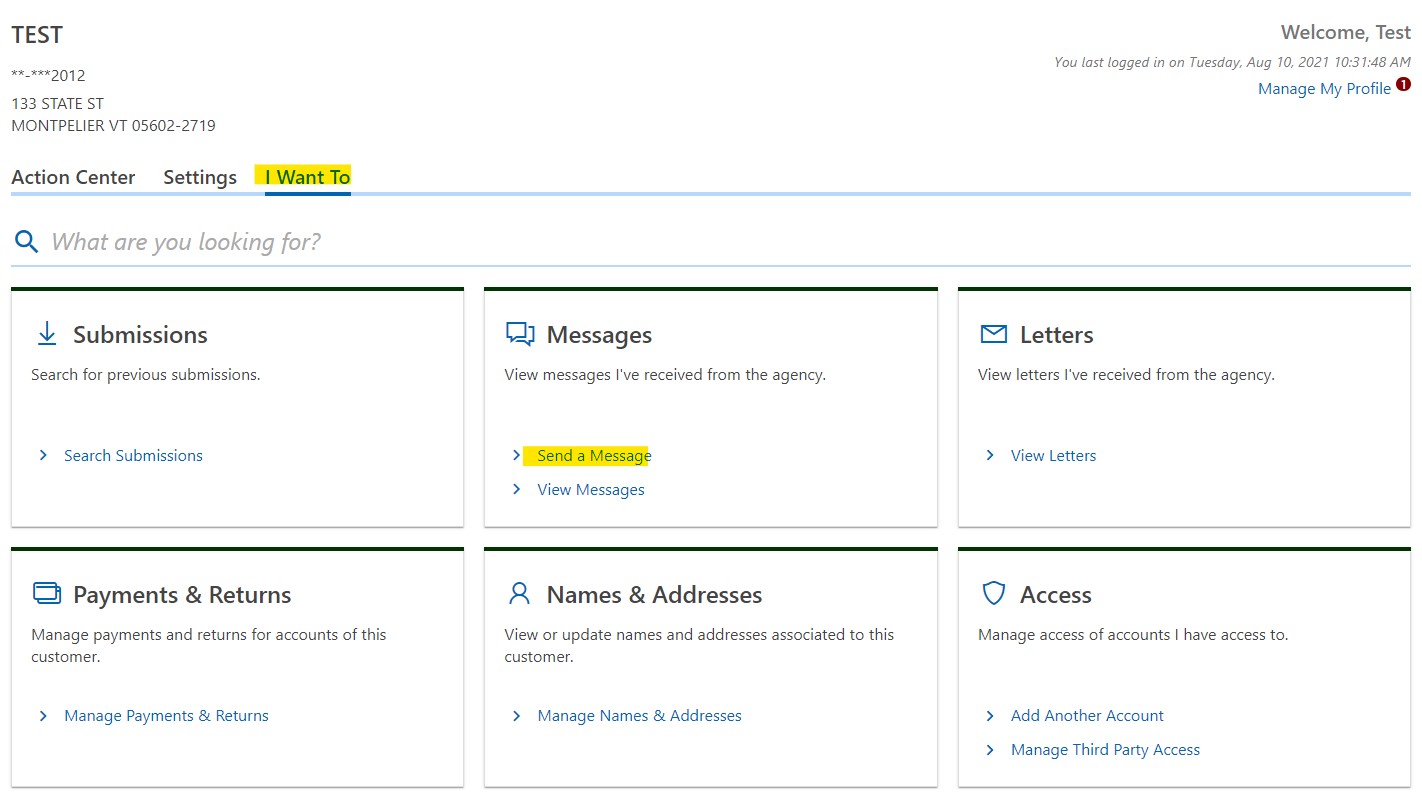

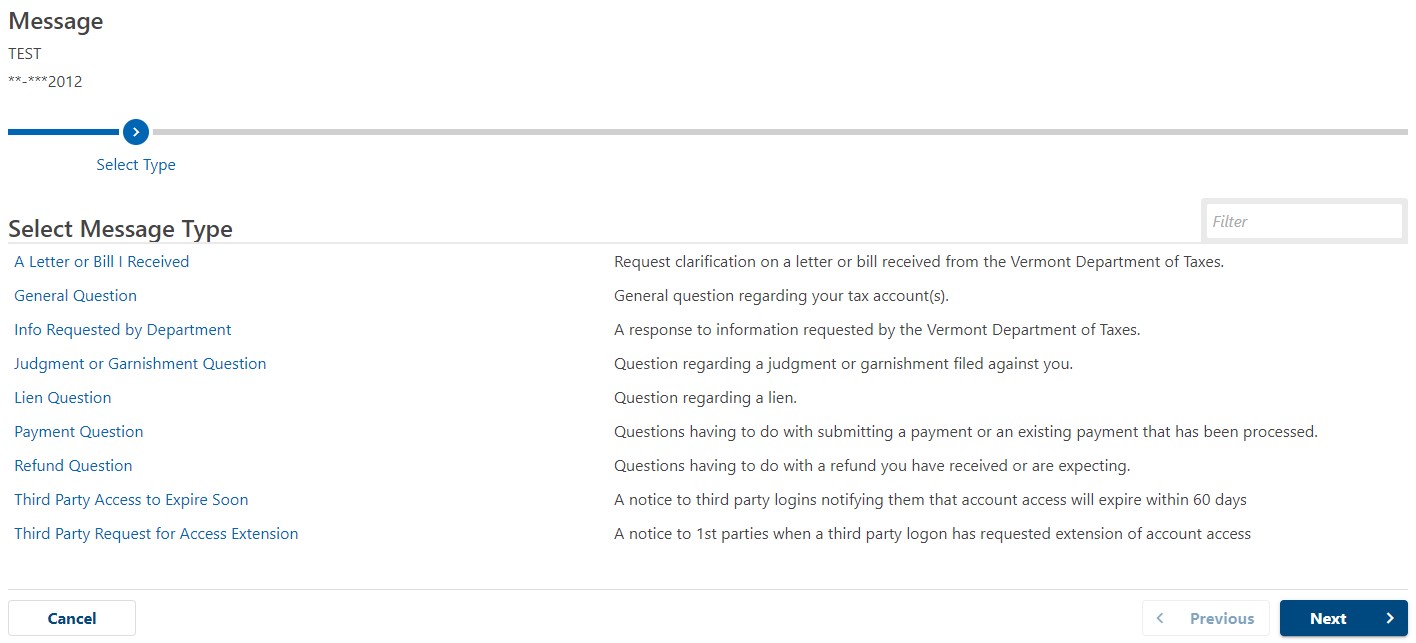

How To Send A Secure Message Department Of Taxes

My Free Taxes Partnership.

. The Vermont Department of Taxes reminds Vermont taxpayers that the due date for federal and Vermont personal income. Fact Sheets and Guides. Fiduciary Income Tax FIT 01700 Fuel Gross Receipt Tax FGR 05000 Healthcare Claims.

IN-111 Vermont Income Tax Return. Click the Sign Up hyperlink in. B-2 Notice of Change.

Sign Up for myVTax. You have been successfully logged out. Send us a message.

Vermont department of taxes myvtax online portal. The Vermont Department of Taxes is pleased to announce the launch of VTax a modern integrated tax system to perform all functions for all Vermont tax types. You may now close this window.

The 3528 is business use 6351800 is rounded to 3500. We are here to answer any questions you have about myVTax. Click the SIGN UP hyperlink in.

Vermont School District Codes. PA-1 Special Power of Attorney. The portion used for business is taxed at the nonhomestead rate.

Stay informed on public health guidelines status updates FAQs and. Please contact the Vermont Department of Taxes Taxpayer Services Division at 802 828-6802 or myVTaxSupportvermontgov. The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal.

Our tax examiners are available Monday through Friday from 745 am. IRS Virtual Service Delivery in Montpelier. Instructions for State of Vermont Departments How to Remit Tax Collections through ACH Credit Processing to the Vermont Department of Taxes Via the Vision Accounts.

Vermont Department of Taxes Issues Refunds to Unemployment Benefit Recipients May 10 2021 May 17 Vermont Personal Income Tax and Homestead Declaration. Vermont Department of Taxes ACH Credit Processing 133 State Street Montpelier VT 05633-1401. Understand and comply with their state tax obligations.

Use myVTax the departments online portal to electronically pay personal income tax estimated tax and business taxes. Please contact the Vermont Department of Taxes Taxpayer Services Division at 802 828-6802 or myVTaxSupportvermontgov. File and Pay Your Taxes.

Taxes for Individuals File and pay taxes online and find required forms. Find the latest information about who is currently eligible to receive a COVID-19 vaccine or booster shot in Vermont. Get Help with myVTax.

How do I sign up for myVTax. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont. Department of Taxes httpsmyvtaxvermontgov_ No Support.

MyVTax is available for corporate and business taxpayers to file their income taxes employer withholding tax sales and use tax meals and rooms tax and other business tax types. If you received Form 1099-G for unemployment compensation from the Vermont Department of Labor and have questions please review information on the Department of Labors website. Call 844-545-5640 to schedule an appointment.

How do I sign up for myVTax.

On Demand Webinars And Training Materials Department Of Taxes

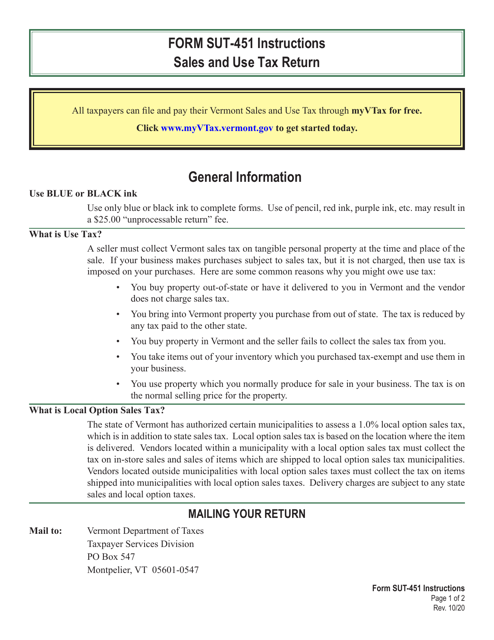

Download Instructions For Vt Form Sut 451 Sales And Use Tax Return Pdf Templateroller

Vermont Department Of Taxes Facebook

Rp 1231 Vermont Department Of Taxes Organizational Chart Department Of Taxes

Vermont Department Of Taxes Mission Goals And Values Department Of Taxes

How To Send A Secure Message Department Of Taxes

File A New Vermont W 4vt Department Of Taxes

Vermont Department Of Taxes Renter Rebates And Refunds Are Processed Separately And May Arrive At Different Times Here S More About The Renter Rebate Including How To Claim It Https Tax Vermont Gov Individuals Renter Rebate Facebook